Kamada revenues reached $12.6 million;

Gross margin in the Proprietary Products segment which includes the Glassia sales reached 43%

Kamada reiterates revenues guidance for 2013 to be $74 million

The company is expecting to complete its phase 2/3 clinical trial in Europe to treat AAT deficiency through inhalation, and will publish its results in the beginning of 2014

Expecting to start in the second half of 2013 a phase 2 clinical trial in the US to treat AAT deficiency through inhalation and a phase 2 or phase 2/3 clinical trial to treat newly diagnosed type-1 Diabetes

Ness Ziona, Israel, May 6, 2013. Kamada Ltd (TASE: KMDA), an orphan drug focused, plasma-derived protein therapeutics company with an existing marketed product portfolio and a robust late-stage product pipeline, announced today results for the first quarter of 2013. Company revenues for the first quarter of 2013 were $12.6 million. As previously reported, due to the timing of orders from Baxter for Glassia and the timetable for the approval of the scaled up production processes in the second half of 2013, the company reiterates it revenues guidance for 2013 to be $74 million, including growth in the Proprietary Products segment to $54 million.

In accordance with the company strategy and working plans for 2013, the gross margin grew in the first quarter of 2013, including the Proprietary Products segment gross margin that grew compared to the first quarter of 2012 and to the annual gross margin of 2012. Gross margin in the Proprietary Products segment reached 43% in the first quarter of 2013, and overall gross margin reached 33% in the first quarter of 2013. This improved gross margin is mainly attributable to revenues recognized from the distribution agreement with Chiesi that was signed in August 2012, after the first quarter of 2012. Revenues for the Proprietary Product segment were $8 million, which is about 65% of total revenues compared to 64% in the same quarter of 2012.

In the Distribution segment gross margin increased as a result of increase in sales of product with higher profitability, versus the decreasing sales of IVIG products and which is in accordance with company plans to expand the portion of its Proprietary Products segment revenues which has higher profitability. In the first quarter of 2013 Distribution segment revenues were 35% of total revenues.

R&D expenses in the first quarter of 2013 were higher than the last quarter of 2012 and similar to the same quarter last year, and include expenses for clinical trials and cost of production facility that were allocated to research and development purposes.

Sales and marketing expenses and general and administrative expenses were at the same level as in previous quarters.

Kamada reports operating losses of $1.3 million in the first quarter of 2013, compared to operating losses of $0.4 million in the same quarter last year.

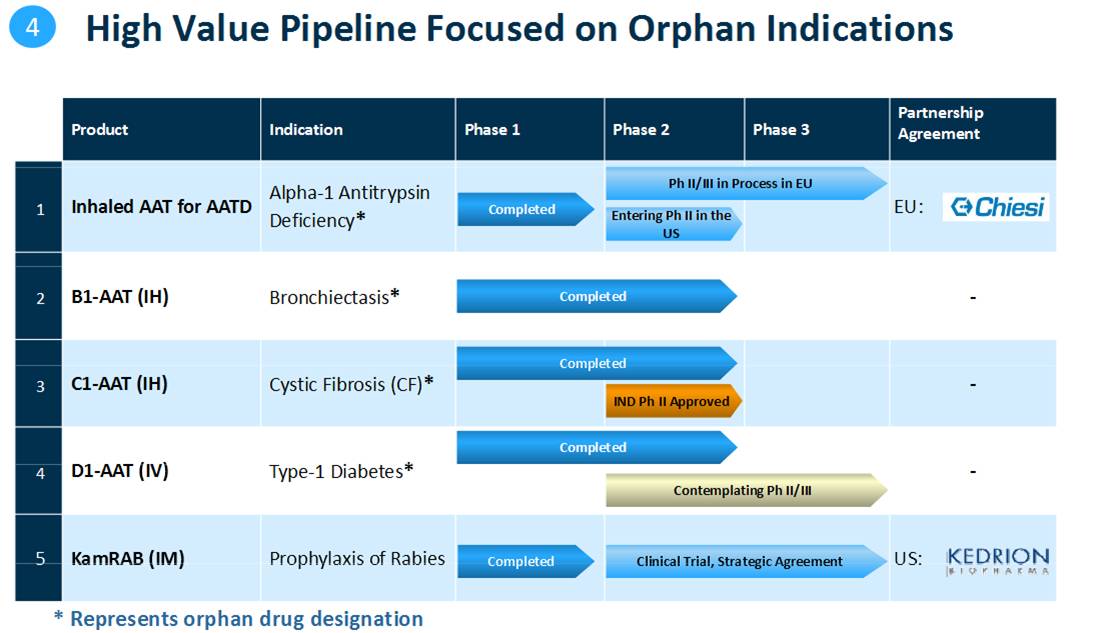

In 2013, Kamada is expecting to complete its pivotal multi-center phase 2/3 clinical trial in the European Union for the treatment of AAT deficiency through inhalation and to publish its results at the beginning of 2014. In addition, the company is preparing to start a phase 2 study for the same product in the U.S. in the second half of 2013. In parallel, the company is preparing to start a phase 2 or phase 2/3 clinical trial this year to treat newly diagnosed type-1 diabetes patients with the D1-AAT product that successfully completed a phase 2 clinical trial.

Kamada reports commencement of treatment of patients in the clinical trial for KamRAB, Kamada’s prophylaxis of Rabies product, which is being conducted in the US as part of the strategic partnership with Kedrion. Kedrion will be the distributor of the product in the US subject to FDA approval.

David Tsur, CEO said ” We continue to implement successfully our strategic plan that includes strong growth in our Proprietary Products segment, mainly based on sales of AAT products in the U.S. and other countries, including commencing sales of our inhaled product in Europe, U.S. and other markets in the midterm, along with improving our margins. The first quarter of this year supports this trend and we are confident in our ability to meet our revenues forecast for 2013, which is based on orders from Baxter for the second half of 2013.”

“On the clinical front, this year we plan to complete the phase 2/3 trial in Europe in our flagship product through inhalation and to start a phase 2 trial in the U.S. that may serve for registering the product in the U.S., subject to successful results in Europe and approval by the FDA. In cooperation with Chiesi, we commenced our preparation for market entry in Europe and subject to the success of the trial and the receipt of regulatory and reimbursement approvals, we believe sales in Europe during the term of the agreement with Chiesi may reach hundreds of millions of dollars.”

In the type-1 Diabetes indication, we are determined to start an advanced clinical trial and to prove the efficacy of AAT to halt the progression of the disease and to maintain the Pancreatic function to produce Insulin. In addition, we are evaluating additional indications for our AAT.”

Additional information is available at www.kamada.com.

For more information, please contact:

Gil Efron

CFO

ir@kamada.com

Cautionary Note Regarding Forward-Looking Statements

This release contains forward-looking statements that involve risks, uncertainties and assumptions, such as statements regarding the EMA and US FDA marketing authorization of our Inhaled AAT for AATD, timing of clinical trials, Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of several factors including, but not limited to, delays or denial in the US FDA or the EMA approval process, additional competition in the AATD market, further regulatory delays. The forward-looking statements made herein speak only as of the date of this release and the Company undertakes no obligation to update publicly such forward-looking statements to reflect subsequent events or circumstances, except as otherwise required by law.

About Kamada

We are an orphan drug focused, plasma-derived protein therapeutics company with an existing marketed product portfolio and a robust late-stage product pipeline. We develop and produce specialty plasma-derived protein therapeutics and currently market these products through strategic partners in the United States and directly, through local distributors, in several emerging markets. We use our proprietary platform technology and know-how for the extraction and purification of proteins from human plasma to produce Alpha-1 Antitrypsin (‘‘AAT”) in a high purity, liquid form, as well as other plasma-derived proteins. AAT is a protein derived from human plasma with known and newly discovered therapeutic roles given its immuno-modulatory, anti-inflammatory, tissue protective and antimicrobial properties. Our flagship product, Glassia, is the first and only liquid, ready-to-use, intravenous plasma-derived AAT product approved by the United States Food and Drug Administration (the ‘‘FDA”). We market Glassia through a strategic partnership with Baxter International Inc. in the United States. Additionally, we have a product line consisting of nine other injectable pharmaceutical products which are marketed, in addition to Glassia, in more than 15 countries, including Israel, Russia, Brazil, India and other countries in Latin America, Eastern Europe and Asia. We currently have five plasma-derived protein products in our development pipeline, including an inhaled formulation of AAT for treatment of AAT deficiency that is in pivotal Phase II/III clinical trials in Europe and entering into Phase II clinical trials in the United States. In addition, we leverage our expertise and presence in the plasma-derived protein therapeutics market by distributing ten complementary products in Israel that are manufactured by third parties.